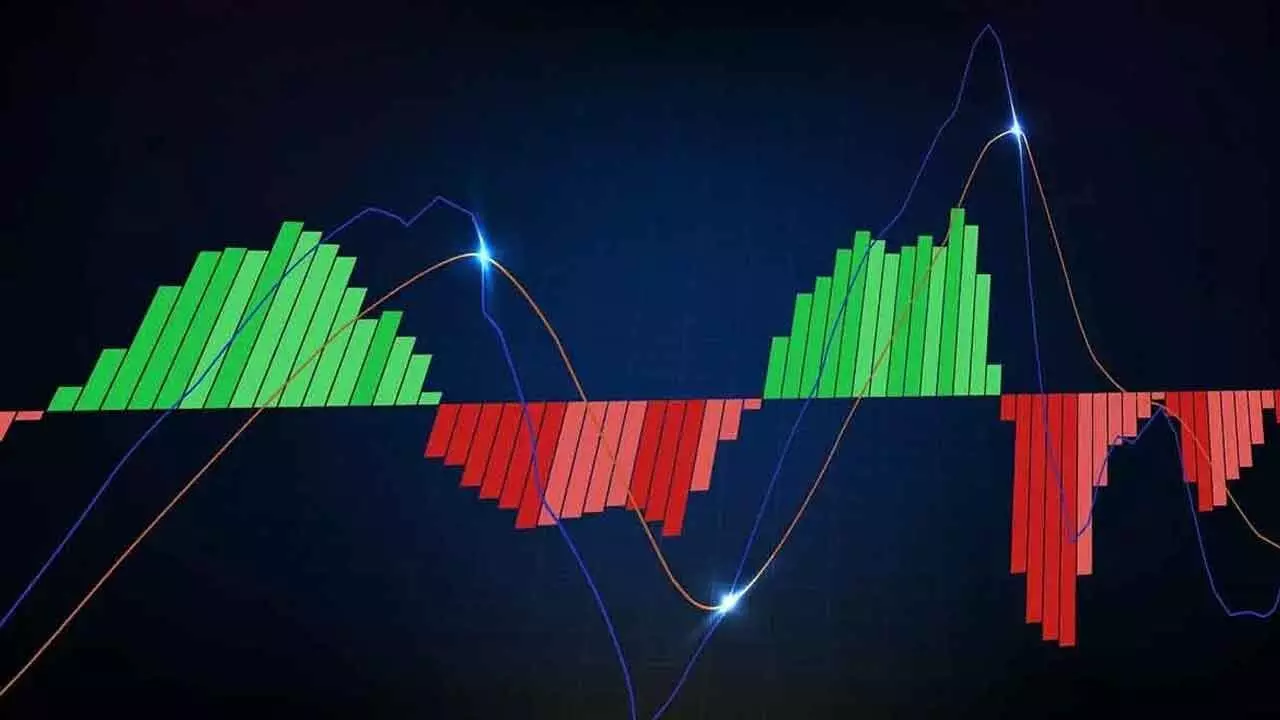

MACD signals increased bearish momentum

Avoid fresh long positions and keep stop losses for existing positions to protect the profits on the table; On a weekly chart, the index formed a strong bearish candle and ended 8 weeks of massive rally

MACD signals increased bearish momentum

There are several evidences of exhaustion. After testing the historically higher zone of 80, the RSI declined to 74.83 on a weekly chart. The weekly volumes were also higher than the average, indicating the distribution

Negative Market Breadth :

♦ 1,630 declines

♦ 1,059 advances

♦ India VIX rose sharply

♦ 108 stocks in upper circuit

♦ 152 stocks hit a new52-wk high

The benchmark indices have given another sign of weakness after making a new high in previous session. NSE Nifty declined sharply by 293.20 points or 1.17 per cent and closed at 24,717.70 points. Except Pharma index, which is up by 0.52 per cent all the sectoral indices closed negatively. The Nifty Realty is the top loser with 3.53 per cent, followed by Auto index with 2.92 per cent. The Nifty IT declined by 1.98 per cent. All other indices declined by 0.30 per cent to 1.85 per cent. The India VIX is sharply up by 10.75 per cent. The market breadth is negative as 1,630 declines and 1,059 advances. About 152 stocks hit a new 52-week high and 108 stocks traded in the upper circuit. Zomato, HDFC Bank, Tata Motors, Maruti and Cummins India were the top trading counters on Friday in terms of value.

The Nifty once again gave reversal signals on the weekend. After a gap-down opening, it closed below the 8EMA support and failed to move above the opening levels throughout the day. But the volume is lower than the previous day. On a weekly chart, it formed a strong bearish candle and ended 8 weeks of massive rally. As we suspected earlier, the Index is trying to come out of extreme zones. There are several evidences of exhaustion. After testing the historically higher zone of 80, the RSI declined to 74.83 on a weekly chart. When the RSI reaches 80, many times the index is corrected at an average of over ten per cent. The weekly volumes were also higher than the average, indicating the distribution. Interestingly, on Friday, the index avoided the distribution day as the volume was less than the previous day. The negative divergence in daily RSI has also almost confirmed its implications. It closed at the prior low. In any case, the daily RSI closes below the 60 zone and will test the 40 sooner than expected. The MACD is also bearish and shows an increased bearish momentum. Keep stop losses for existing positions to protect the profits on the table. Avoid the fresh long positions.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)